What Are The Safest Ways To Borrow Money From Banks In Egypt?

Maximizing Loan Benefits with Financial Technology

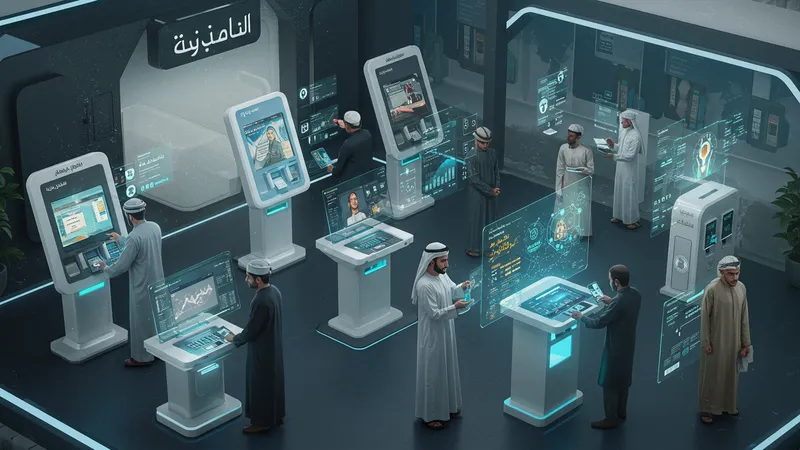

As financial technology continues to infiltrate Egypt’s banking sectors, the synergy between tech advances and loan accessibility becomes ever more evident. From AI-driven loan approvals to blockchain-based secure transactions, the influx of cutting-edge technology is changing how Egyptians experience and benefit from loans. Instant feedback systems powered by AI algorithms have notably reduced the waiting time for loan approvals, reshaping efficiency norms within the industry. The further possibilities embedded in these tech advancements are equally exhilarating…

For borrowers, embracing financial technology facilitates a direct connection with banks, promoting personalized loan options crafted from predictive data analytics. Customers can receive tailored notifications on better loan refinancing opportunities and optimize their debt management strategies through automated alerts on payment deadlines. This enhanced connectivity signifies a giant leap towards customer-centric financial engagements. Yet this transformation points to a larger disruption in traditional finance soon to be unfolded…

Capitalizing on technology, several banks have also ventured into offering ‘digital credit scores’, a dynamic reassessment process that responds instantaneously to any changes in borrower profiles. The transparency afforded by these scores engenders a more equitable borrowing ecosystem, where merit-based assessments transcend historically biased credit evaluation methods. With a steady rise in tech-savvy consumers, demand for such innovations is consequently climbing. But lurking beneath are questions regarding long-term implications on conventional banking operations…

This transformative thrust towards tech-enhanced financial services continues to blur conventional boundaries in loan logistics, beckoning numerous opportunities for consumers and institutions alike. As more layers of financial services become imbued with technological prowess, previous limitations appear obsolete, heralding a new era of flexible, efficient banking. This disruption indicates a powerful shift with profound effects on future economic participation policies. The question remains as to how these developments will further materialize in the years to come…