What Are The Safest Ways To Borrow Money From Banks In Egypt?

Exploring Peer-to-Peer Lending as an Alternative

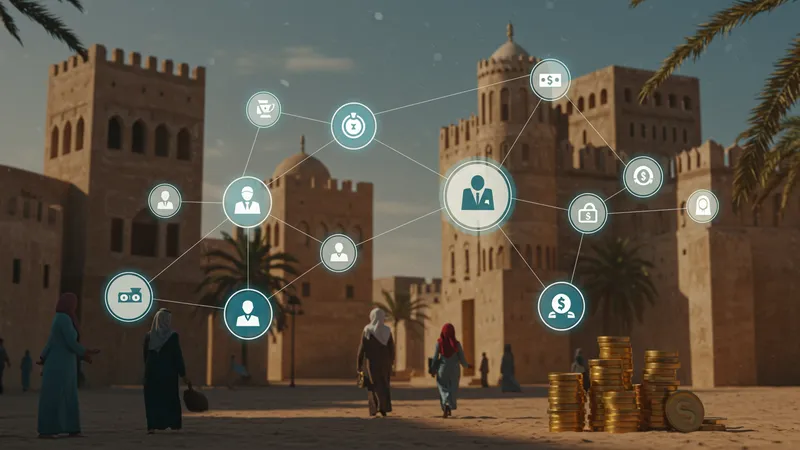

While traditional banks dominate the Egyptian credit market, peer-to-peer (P2P) lending has emerged as a noteworthy alternative, offering distinctive benefits. This growing trend allows borrowers to interact directly with potential lenders via specialized P2P platforms, fostering transparency and competitive interest rates. For many, this community-driven model has reduced reliance on conventional banking channels, augmenting their access to funds. Yet, exploring the P2P ecosystem reveals a host of additional layers…

In practice, the appeal of P2P lending extends beyond mere transactional simplicity. Individuals often report having greater flexibility in negotiating terms and conditions, a luxury typically unavailable within traditional banks. P2P platforms cater predominantly to underserved customers with limited conventional credit access, providing essential financial inclusivity. However, while promising, they necessitate careful consideration regarding trust and credibility metrics. The tension these platforms introduce to established bank norms provokes further reflection…

Interestingly, evolving regulatory frameworks strive to balance P2P’s independence with necessary consumer protection protocols. Stricter regulatory oversight seeks to safeguard user interests without stifling the innovation integral to P2P success — an intricate dance that continues to unfold. The alignment of regulatory policies poses intriguing implications for the broader financial market, urging dynamic adaptation to emerging consumer attitudes. But even as policies mature, does the P2P lending model sustain its current momentum?

The reality of P2P lending hinges critically on user safety and the platform’s ability to nurture community trust. Innovative technologies like blockchain are envisaged to fortify transactional integrity, ensuring a secure environment for users. As more tech-oriented safety measures ascertain P2P viability, they herald an era of diversified financial provisions — blurring the demarcation between conventional and alternative credit channels. The potential for enhanced financial access in Egypt catalyzed by such models beckons a close examination.