What Are The Safest Ways To Borrow Money From Banks In Egypt?

Understanding and Utilizing Interest Rates to Your Advantage

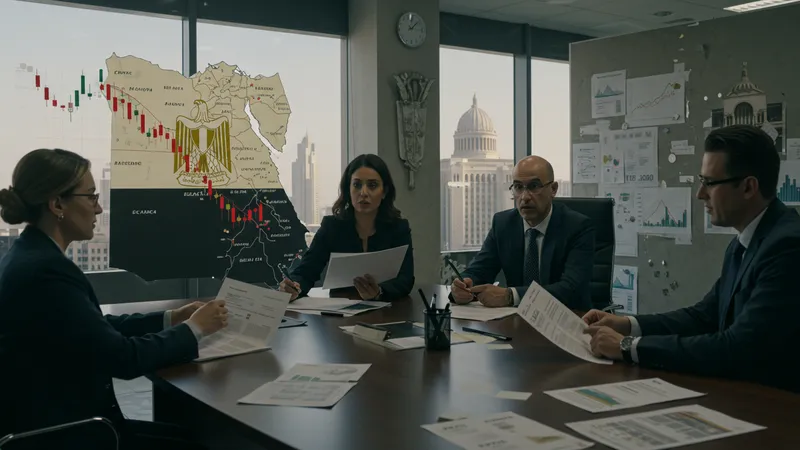

Comprehending interest rate dynamics is fundamental to optimizing borrowing strategies in Egypt. Interest rates, influenced by macroeconomic policies, have fluctuated significantly, underscoring the necessity for borrowers to seize favorable rates opportunistically. This involves staying informed about central bank decisions, which directly influence consumer loan rates. Those leveraging financial advisories for timely rate predictions have reaped substantial savings on their borrowing costs. But this is only a fragment of the larger interest rate narrative…

Interestingly, banks have introduced fixed versus variable rate discussions as part of their client offerings — imparting insights into the benefits and risks associated with each option. Borrowers are now equipped to strategically select the rate type that aligns with their financial stability goals; for instance, opting for fixed rates amidst upward rate trends or variable rates to benefit from any future cuts. This evolving rate strategy indicates a nuanced approach to loan product engagement. The deeper intricacies of this approach reveal untapped wisdom…

Additionally, understanding rate conversion impacts opens up new avenues for borrowers. Long-term loans, for example, may benefit from transitioning between interest models during favorable economic conditions. Banks foster relationships with consumers to advise them on optimal timing and rate conversion advantages, deepening consumer trust and reinforcing cooperative engagement. The strategic maneuvering around rate fluctuations remains crucial for effective borrowing, though further layers exist yet to be explored…

Effectively, interest rates become a tool for optimizing financial health when coupled with robust planning. Borrowers benefit from aligning economic forecasts with personal financial trajectories, unveiling proactive strategies that cement fiscal security. The implications of this strategic alignment are pivotal, signifying a shift towards dynamic borrowing models responsive to changing economic climates. What follows may reshape cultural perceptions of loans and interest management for years to come…