Know About Health Insurance Providers In Pakistan: A 2025 Overview

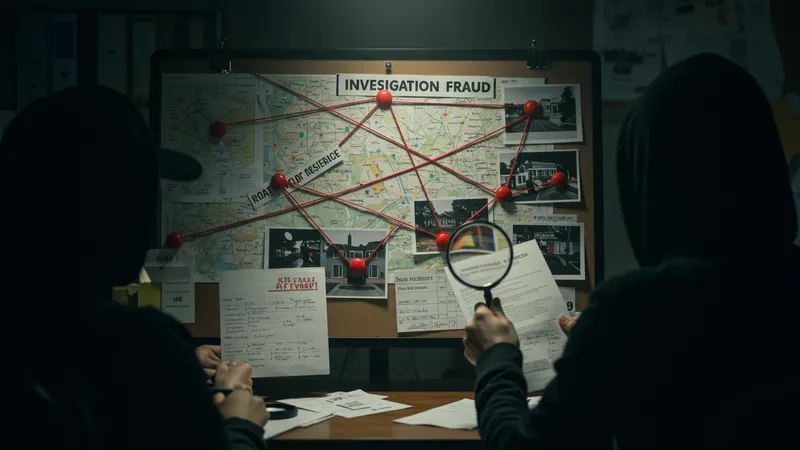

The Unspoken Realities of Insurance Fraud

Insurance fraud, although often brushed under the carpet, is a significant concern for the industry. It inflates premiums and undermines trust. But to address it, one must first understand its complex web. The tactics used are ingenious, and what’s really unfolding might just shock you…

The mismatch of documentation and actual service provision is a classic fraud method that sees millions being lost to fake claims every year. Auditing such fraud requires unseen resources and exposes procedural weaknesses. Might we be ignoring the real villains here? This correction process isn’t as straightforward as it seems…

Technological advances like AI and machine learning now aid in fraud detection. But these innovations meet a savvy adversary, spotlighting whether we’re truly equipped to battle this ever-evolving deceit. The ethical stakes add a layer of introspection on regulatory diligence…

To combat this, insurers are promoting awareness initiatives, encouraging consumers to understand and report fraud. This represents a grassroots approach with intriguing potential. Change, however, needs collective consciousness — are we inspired enough to shoulder this responsibility? This narrative is uncovering a side of insurance rarely discussed…