Is Private Health Insurance In Egypt Really Worth The Cost?

The Real Costs of “Premium” Services

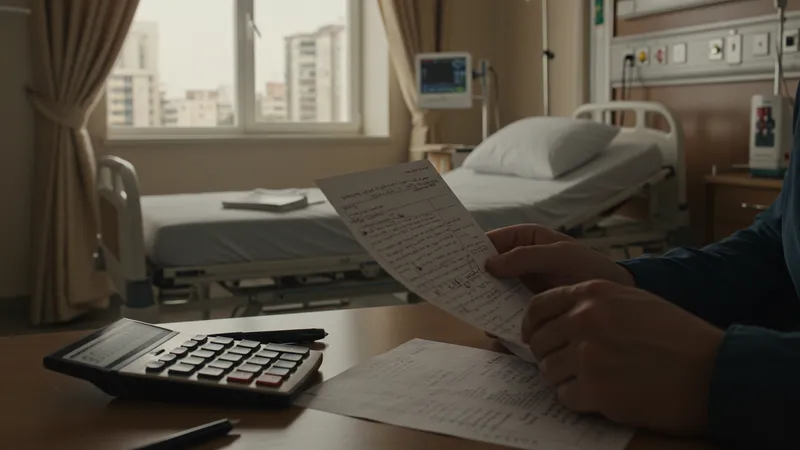

Premium or VIP services advertised by insurance companies in Egypt often entice potential clients with promises of luxuries like private hospital rooms and expedited treatment. However, these offerings come with a price that might not always equate to value. Premium does not invariably mean better care. Instead, it usually means higher costs borne by the client, sometimes adding more than 40% to the base cost of insurance. But there’s a startling underlayer to this glittering ‘premium’ promise…

Interestingly, many of these premium services involve additional costs not disclosed upfront. For example, access to specialist consultations or screenings could still incur out-of-pocket expenses if the usage exceeds a predefined limit. Companies might market ‘direct billing’, yet this often applies to only a limited network of hospitals or clinics. So what truly defines premium? The answers might surprise you.

There’s also the question of hidden fees. Some customers have reported unexpected administrative charges added to their bills, often buried in the small print of policies. This layered complexity not only confuses the insured but also results in higher cumulative costs. Most clients are unaware until they are caught off-guard by hefty bills, realizing their presumed premium package wasn’t all it was cracked up to be.

The idea of exclusive healthcare can appeal to many, yet its actual benefits and pitfalls are less discussed. How can the term ‘premium’ be reevaluated? The following insights may just flip the narrative on what you thought you knew about high-tier health plans.