Is Private Health Insurance In Egypt Really Worth The Cost?

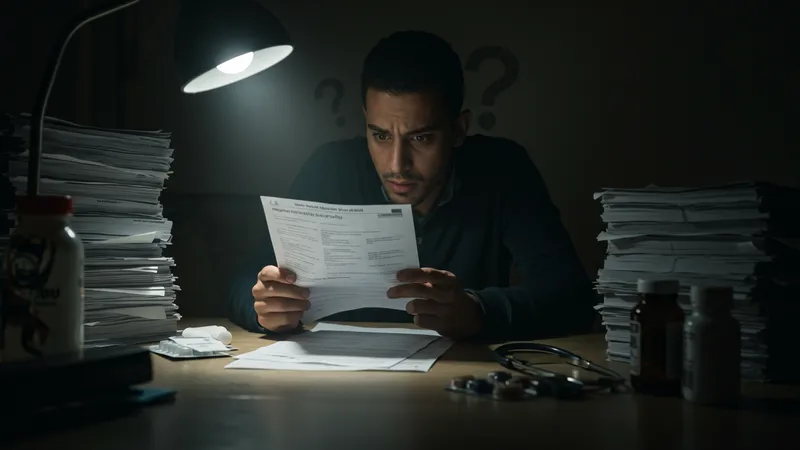

The Overlooked Fine Print in Policies

Many policyholders assume that their insurance covers them for any scenario. In reality, private health insurance policies in Egypt often have a myriad of exclusions buried deep in the fine print. These exclusions can relate to specific treatments or illnesses, leaving many without the coverage they thought they had. This can be distressing, especially when unexpected medical needs arise and the costs fall heavily on the insured. Yet, there’s a hidden catch within these documents…

Some insurance providers have cleverly disguised caps on benefits in their policies. For instance, while your policy might advertise coverage of all surgical procedures, it may only cover them up to a certain limit. Beyond that, out-of-pocket expenses start to soar. The real shocker is that many find out about these limits only during an emergency when it’s too late to make alternate arrangements.

Furthermore, pre-existing conditions remain a significant bone of contention. Some insurers in Egypt, while claiming to cover chronic conditions, do so at the expense of very high premiums. It’s a delicate balancing act that many are forced to navigate, often without full awareness of their options or rights. But what if I told you there’s a strategy to beat these tricks?

Understanding how to choose the right individual policy that aligns with one’s medical needs and financial capabilities can be daunting. Yet, industry insiders hint that knowing one simple fact can turn the tables in your favor. What you read next might change how you see this forever.