Compare Health Coverage Options In Pakistan Today

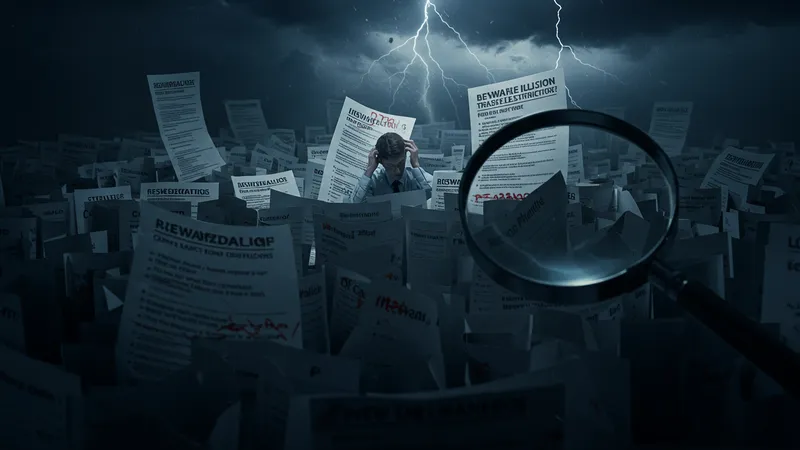

The Dark Side of ‘Comprehensive’ Plans

Often branded as the ultimate shield against medical expenses, ‘comprehensive’ health plans are not always what they claim to be. Skeptical consumers are digging deeper and realizing the hidden caveats. These plans might exclude vital procedures or medical conditions that can render them ineffective when truly needed. But why do they persist? There’s a story here no one expects…

Insurance jargon can often conceal more than it reveals. Terms like “pre-existing conditions” or “network restrictions” sound innocuous but can surprise holders when claims are made. Internal reviews often indicate discrepancies between what’s promised versus what’s delivered. Some face regulatory scrutiny, while others undergo public outrage. The transparency issue is a ticking time bomb awaiting detonation.

Moreover, policyholders may not realize the limits of their coverage until it’s too late. Imagine being hospitalized and learning certain facilities or treatments aren’t included. Frustration mounts and financial stress escalates, leading many to regret their initial choice. What if this knowledge was more accessible? This oversight could lead to reforms that modify the whole sector’s approach.

If comprehensive plans aren’t all they’re cracked up to be, what’s the alternative? As disillusionment grows, more look into customizable plans or hybrid models. These emerging options may just offer the best of both worlds, but who dares to challenge the status quo? Keep reading to see the unexpected strategies surfacing in the landscape…