Compare Car Insurance Policies: Find The Best Deals In 2025

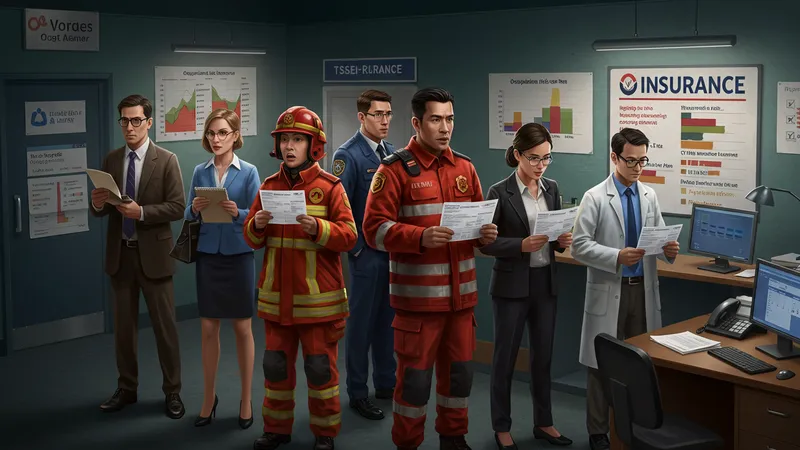

Your Career and Insurance Rates

Believe it or not, your job title could be affecting how much you pay for car insurance. Insurers have long gathered data on which professions are deemed more ‘risky’ drivers. For instance, journalists and emergency responders often face higher premiums than teachers or scientists. This risk assessment is based on behavioral data linking certain occupations to an increased likelihood of accidents. But the real kicker is the baffling inclusion of some roles that ostensibly have no connection to road safety.

One recent example saw insurance rates spike for IT professionals as AI-driven algorithms flagged a supposed increase in distracted driving. Yet, many argue this trend unfairly targets individuals based on weak correlations rather than substantial evidence. The insurance industry defends these practices, claiming they are rooted in data, but questions about ethical profiling continue to rise. Could your career be costing you hundreds annually? The answer may surprise you.

Efforts to combat these job-related pricing models are gaining traction in various states, as advocates push for transparency and fairness. The emerging discourse surrounding digital privacy and discrimination plays a crucial role in this debate. As concerns over data usage grow, some have even called for a complete overhaul of insurance pricing methods. The tide may be turning, but there are far more layers to this issue left to explore.

While the job you hold today could be hiking up your rates, leveling the playing field may demand more than simply policy reforms. Future insurance models may rely heavily on real-time data and individual habits rather than demographic stereotypes. Delving into such innovative approaches could indeed hold the key to a revolution in how policies are priced. Still, what comes next could turn everything you know about car insurance on its head.