Compare Car Insurance Policies: Find The Best Deals In 2025

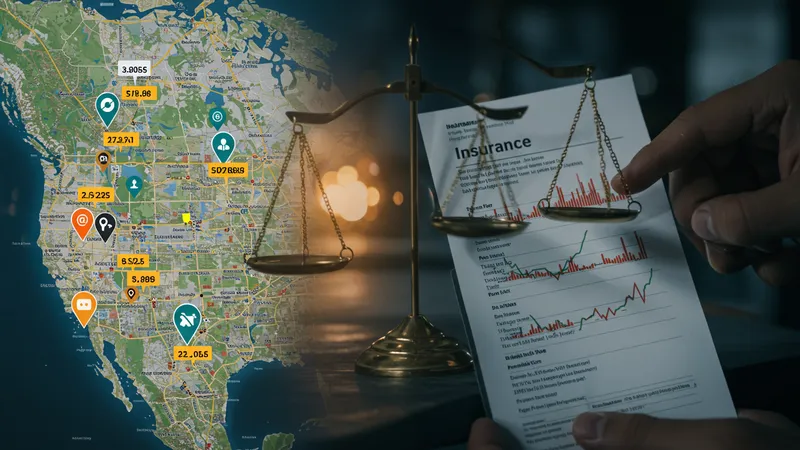

The Surprising Impact of Your Zip Code

In the realm of car insurance, one might assume that policy prices reflect a straightforward equation of risk and coverage. However, the reality is far from simple. A startling 2023 study showed that simply crossing into a different zip code can alter premiums by a staggering 300%. This discrepancy arises from insurers using zip codes as a proxy for accident risk, crime rates, and even the average repair costs in the area. What you read next might change how you see this forever.

But there’s a twist—some companies have begun to move away from this geographic pricing model, recognizing its potential unfairness. Progressive states are even enacting laws to prohibit such practices, aiming to create more equitable pricing methodologies. These changes signal a major shift in how insurance companies assess risk and could have sweeping implications for consumers nationwide. Yet this geographical disparity is not the only hidden factor undermining fair pricing.

There’s an unfolding battle in the courts between consumer advocates and insurance corporations over zip code pricing. Advocates argue that it unfairly penalizes residents of urban areas, where premiums are often significantly higher due to denser traffic conditions and higher crime rates. Meanwhile, insurers claim it’s a necessary measure to maintain solvency and competitive pricing. This ongoing saga could redefine insurance pricing—but there’s still more to unravel.

How do you navigate this potential minefield of pricing based solely on your location? Savvy drivers are turning to newer, digital-first insurers that offer alternative ways of gauging risk, such as tracking driving habits through telematics devices. These innovations might be the key to unlocking fairer insurance rates, allowing drivers to break free from their zip code chains. Yet, there’s a deeper controversy brewing beneath this surface, which you’ll soon discover.